Indian Railways (IR), the national railway system operated by the Ministry of Railways, has invited proposals from private players to run 150 modern passenger trains on 112 pairs of routes centred around major urban cities such as Mumbai, Delhi, Chennai and Kolkata. The project is expected to entail an investment of about INR 300 billion. Through private sector participation in passenger railways, the IR is looking to offer more seats and add capacity in the reserved (PRS) category, which at present contributes about 20% of the total passengers but generates about 65% of total passenger revenue.

The IR currently faces immense supply-side constraints and is unable to meet growing demand in the passenger segment. In 2018-19, around 88 million of waitlisted passengers, could not be accommodated, which is approximately 15% of reserved category passengers. The capacity constraints have led to a loss of high-end passenger demand to airways (during the last five years, the reserved category has grown at a CAGR of <5% vis-a’-vis +10% growth in air traffic). To meet this growing demand-supply gap and add capacity, there is a dire need for investment in the railway sector. However, given the financial constraints, IR does not have the bandwidth to deliver the needed capacity. Given the increasing fiscal burden on the government due to the COVID-19 pandemic, the private sector participation becomes imperative to support railway capacity augmentation.

In the current bid for inviting proposals for running trains on 100+ route pairs, the existing routes are presently saturated and operate at near full capacity. However, with the dedicated rail freight corridors expected to be commissioned in 2021, the congestion on key trunk routes – Delhi-Mumbai and Delhi-Howrah – are set to ease, with IR hoping to use the freed-up capacity to run more passenger trains.

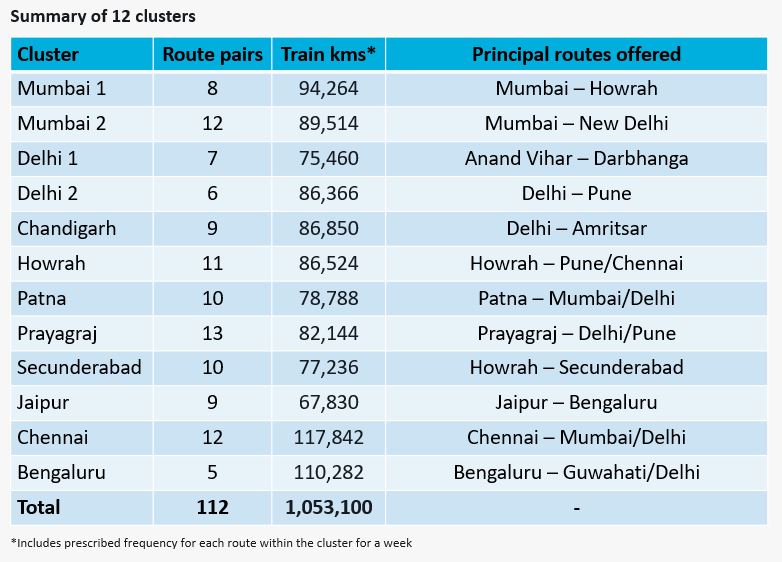

As per the recently invited request for qualification (RfQ) by the Railway Board for 12 clusters, the private players will be responsible for financing, procuring, operation and maintenance of the rolling stock with the right to determine and collect fares for a concession period of 35 years. The bid document expects the selected private player(s) to operate at least 12 modern trains in each cluster with next-generation technology and provision of higher service quality to ensure reduced journey time. A bidder can bid for one or more clusters; however, no bidder shall be awarded more than three clusters. The private players will be selected through a two-stage competitive bidding process and the bidders offering the highest share in the gross revenue will be shortlisted for a specific cluster.

Each of the 12 clusters consists of a mix of short (<500km), medium (500-1,000km) and long (>1,000km) routes, with each cluster typically including one or two principal routes. This mix of short and long routes will enable the operator to cater to a wider market of user demand such as daily commuters, business travellers and overnight travellers making a long-haul journey.

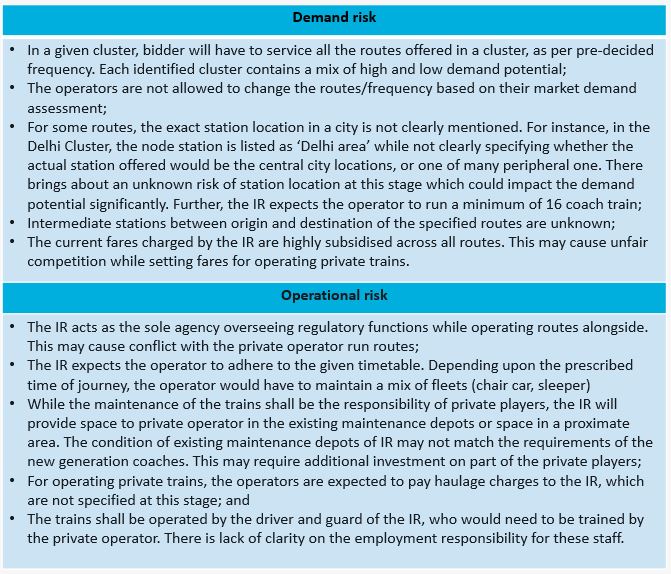

The new service routes will potentially create induced and diverted demand, as equivalent high-speed and high-quality railway services do not currently run on many existing routes. Behavioural change is also expected towards a better quality of rail travel in the future owing to the COVID-19 pandemic. It is expected that passengers will also be willing to pay more for cleaner modes of travel with hygienic food and better washroom facilities, leading to increased demand for trains offering better services. However, the current proposal opens the passenger train market to private operators only with limited possibilities with associated risks. The two associated risk categories include demand risks and operational risks, which are highlighted in the box below.

The risks associated with private investment in infrastructure remain a challenge, even more so in a dynamic economy like India. The lessons that Steer has learnt while working in countries such as Spain, Italy, London and France, among others across the globe, will help us deliver more informed views to the investors in order to assess the associated risks involved in such an investment. We are an established advisor to the rail sector globally and can offer a wide range of services from our global expertise in demand assessment (passenger forecast, segments of user demand), supply-side solutions (network assessment and operational plan) and commercial strategy (rolling stock model). Our combined knowledge and experience of working on similar international projects can help us be part of the key transformation that the IR has initiated.

We believe this is a good step, one that is in sync with the government’s idea of introducing reforms in Indian Railways and achieving the much-needed capacity. The comprehensive contractual agreements and adequate clarity in the sharing of risks will be important to make this initiative successful. Prior to investing in any asset, the investors will do their required due diligence. Going forward, it is yet to be seen how acceptable these risks will be to the investor community.